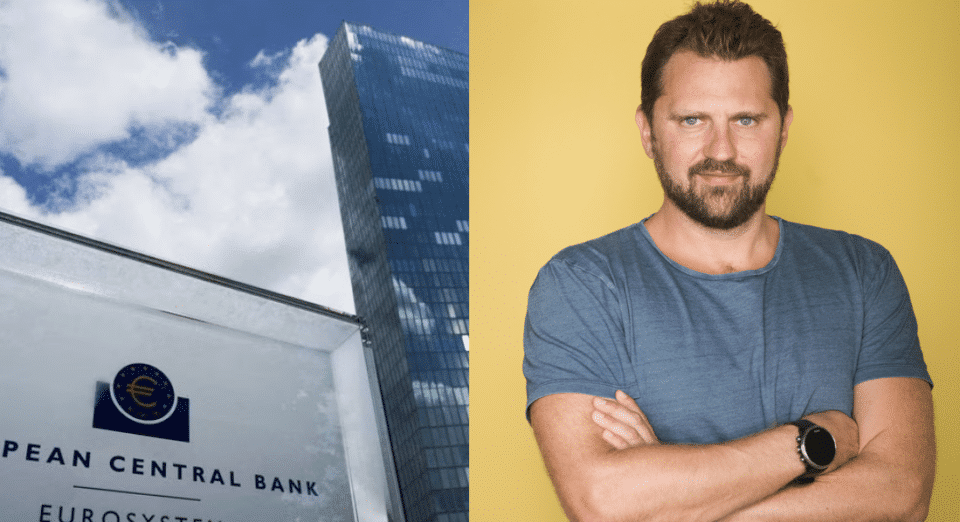

ECB and Fed could match rate cuts in 2024, says fintech CEO

The European Central Bank (ECB) recently kept interest rates at their current levels but indicated that the September meeting is “wide open” as it downgraded its economic outlook for the eurozone and predicted continued falling inflation.

ECB President Christine Lagarde said that risks to growth are now “tilted to the downside,” signalling a potential rate cut in September.

Lagarde also stated that growth likely slowed in the second quarter, with weak investment and industrial output suggesting muted future expansion.

This outlook supports expectations for further rate cuts to suppress price pressures.

However, Lagarde refrained from committing to a specific rate path, emphasising data-driven decisions.

Commenting on this decision, Victor Trokoudes, CEO and founder of fintech Plum, which has offices in Nicosia, Athens and London, said that “there was no surprise in the ECB’s decision to cut rates in the previous month given it was so well trailed”.

He added that similarly, the ECB’s latest decision to hold rates was widely expected.

However, he pointed out that people will have been looking closely for clues as to the scale and timing of any forthcoming cuts.

“Expectations are high for the next rate reduction to be in September, but the ECB will naturally be trying their best to give themselves as much scope as possible to be flexible to respond to incoming economic data rather than box themselves in,” Trokoudes stated.

“It’s likely then that Lagarde will continue to emphasise that the Council will be data-dependent and make decisions on a meeting-by-meeting basis,” he added.

He explained that “this is reinforced by the fact that by September, the ECB will have been able to analyse two more monthly consumer-price readings, and have new forecasts as well”.

What is more, the Plum CEO noted that the recent political upheaval in France will add to the ECB’s caution.

“Populist pressures,” he continued, “not only in France but elsewhere could mean less effort to shrink budget deficits and extra spending.”

“This would likely stimulate demand and lift core inflationary pressures,” he said.

“So the ECB will be keen to stress its message of fiscal discipline,” he added.

Additionally, Trokoudes mentioned that the recent, better-than-expected fall in US inflation will offer some respite to the ECB.

Markets are now anticipating three rate cuts by the Federal Reserve this year, suggesting a possibility where both the ECB and the Fed might end up reducing rates the same number of times in 2024.

“This will help to mitigate dollar strength which has been a challenge in the EU’s fight to reduce inflation,” he said.

He also mentioned that “wage growth and services inflation still remain relatively high, despite the overall inflation rate improving”.

“But while the labour market continues to show resilience, Lagarde will also be closely monitoring Eurozone growth which has shown signs of weakness recently, for example, profit margins at Eurozone companies beginning to fall at the start of this year, leading her to call the growth outlook ‘uncertain’,” the fintech head stated.

“In this context, making real-term returns from cash is crucial as higher rates may not last much longer. Europeans need to ensure that their savings are still growing, at the very least in real terms,” he added.

“Banks will be tempted to decrease their savings rates at a higher pace than the ECB’s decrease in anticipation for further cuts, especially for fixed-term savings accounts,” Trokoudes concluded.