South African households under R2.5 trillion debt stress

Consumers are spending more than 40% of their disposable income on repaying debt, survey shows

South African consumers, who collectively owe more than R2.5 trillion, are stressed about high personal debt levels, and many are spending more than 40% of their disposable income on repayments.

Their top three stress points are running out of money before the end of the month, not being able to meet all their debt repayments and interest rate increases, followed by worries about unexpected expenses, inflation, school fees and retirement.

These are among the findings of DebtBusters’ third annual money stress tracker, which is based on an online survey of 26 000 consumers who are not under debt review. It is one of the largest online surveys about how financial stress affects the lives of South Africans.

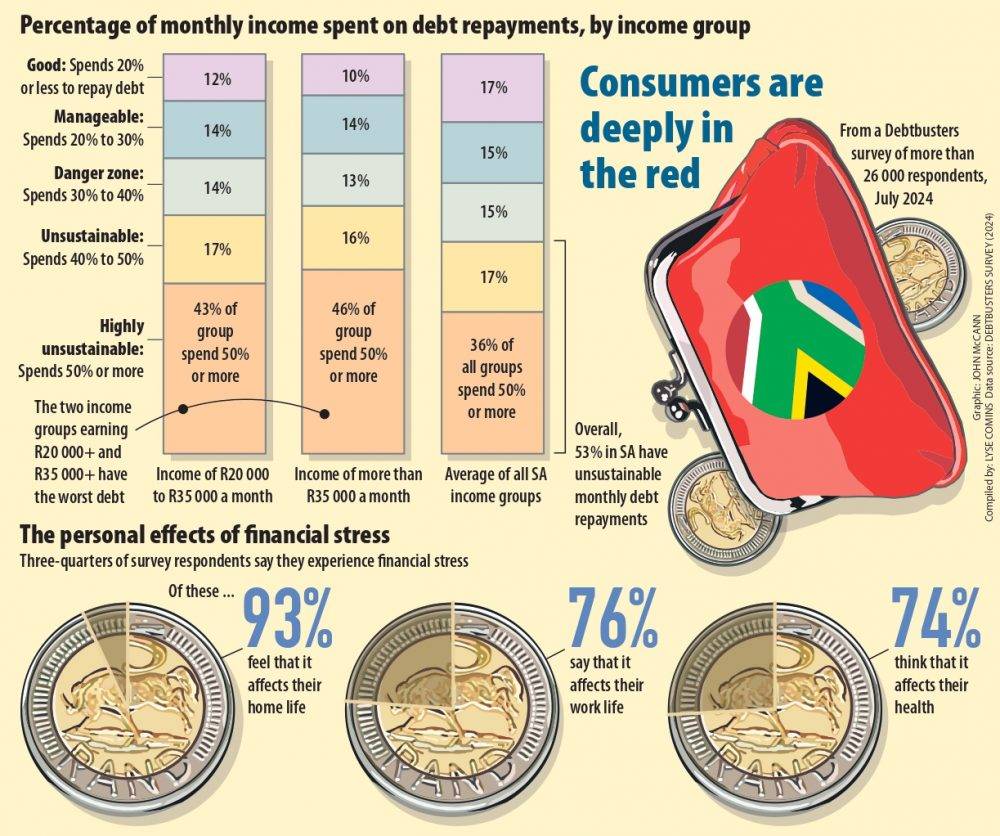

Highlighting the survey’s findings on Wednesday, DebtBusters executive head Benay Sager said levels of financial stress have remained high for the past three years, affecting consumers’ home and work lives as well as their health. He said 75% of those surveyed reported experiencing financial stress, a slight decline from 78% last year but still higher than the 70% recorded in 2022.

“While the data points to a marginal decline, it is still at an elevated level. The trend over the three-year period is upwards,” Sager said.

A concerning trend is that a high number of respondents are spending more than a third of their after-tax income on debt repayments.

“About 68% of consumers overall are spending 30% or more of their take-home pay on debt repayments. This is in the danger zone.

“Alarmingly, 53% of consumers are spending 40% or more of their take-home pay to repay debt and that is definitely not sustainable,” he said.

“Generally, consumers are advised not to spend more than 30% of take-home pay on debt repayments — at most 40%.”

Sager said the survey showed the “huge pressure” on middle-class people earning more than R20 000 a month and on people aged 45 and up who have “unsustainable” debt levels.

“These are the backbone of South Africa’s middle-class population. The research clearly reveals that older people with higher incomes are under the greatest debt repayment pressure, yet are most resistant to seeking help.”

Despite having the highest levels of unsustainable debt, this group is least worried about finances, Sager said.

“They cite not knowing who to trust as the main reason for inaction.

“By contrast, 54% of younger consumers show intent in dealing with money stress although they are not always sure of the options available to them. The under 35s say they are embarrassed, while the 35-plusses tend to procrastinate,” he said.

According to the survey, conducted last month, concerns about interest rate increases declined by 22% compared to last year, while those concerned about load-shedding declined from 17% to 7%. Of the 75% of people who said they feel financially stressed, 93% said this was negatively affecting their home life, 76% their work life and 74% their health.

Compared with men, women are 10% more worried about finances with almost four out of five saying they suffer from financial stress.

They are also 20% more stressed about health and 30% more stressed about home life. Younger people with lower incomes are the most anxious about their finances.

Women are more inclined to express their stressors, and to constantly analyse them, while men compartmentalise stress by focusing on one issue at a time, psychologist Andrea Kellerman said.

“More women are taking on the dual responsibility of being mothers and breadwinners. This adds on another layer of pressure and the double burden contributes to heightened financial stress,” she said.

According to the latest Credit Bureau Monitor Q1 2024 report, published by the National Credit Regulator in May, millions of consumers are not coping and are defaulting on their debt repayments.

It said out of the 27.92 million credit-active consumers, 10.09 million have impaired credit records. This is a 2.7% increase of 190 428 consumers with poor records compared with the first quarter of last year.

DebtBusters has helped people escape the debt spiral, including single mother Janet Scott who was under financial stress.

“My life revolved around worrying about money, where it was going to come from, how much I needed, how much I was going to be short. It’s a totally dark place, and you keep going over the same negative thoughts.”

Ashley and Chantal Benjamin said their final straw to seek help was when they had to choose between buying food and paying off debt.

Joshua Roode said he had to overcome his embarrassment to seek help.

“There were more months than there was money … I felt like … a failure, but that’s part of life, either winning or learning. I stopped worrying about what anybody else thought, because I had to do this to get to where I need to be,” Roode said.

“It opened up a lot of conversations, because it turns out a lot of people are actually sitting in a situation where they’re also struggling …most people are intrigued, not judgmental.”

Economists say households with debt are not likely to get a reprieve from elevated interest rates until later this year and some have accused the South African Reserve Bank of keeping the repo rate unnecessarily high to the point of stifling consumption and economic growth.

On the national average mortgage bond level administered by BetterBond of R1.1 million, home-owners are now paying around R4 000 a month more on instalments since the start of the interest rate hiking cycle in November 2021, said Roelof Botha, economic adviser to the Optimum Investment Group.

Botha said since the onset of restrictive monetary policy in South Africa, the financial resilience of households has been under pressure, as highlighted in the Altron Fintech Household Resilience Index. The economic gains made during the Covid-19 recovery period had been “wiped out” by the highest interest rates in 15 years.

“Over the past four years, the average real salary in the formal private sector has declined by 8% to a level of R18 500,” he said.

“Excessively high interest rates have further exacerbated the plight of South African households by a sharp increase in debt servicing costs which, as a percentage of household disposable income, has now risen to 9.2% — the highest level in 15 years, and significantly higher than before the Covid pandemic,” he said.

Botha said if the prime overdraft rate was lowered to 10%, where it was just before the pandemic, it would translate into a real lending rate of 4.4%. This would allow households breathing space to service debt and encourage consumption expenditure, which has been growing at a meagre 0.6% annual average in real terms since 2019.

“Restrictive monetary policy by the South African Reserve Bank since the end of 2021 has raised the cost of credit, and of capital, by 68% measured against the nominal prime overdraft rate.”

He said although inflation had moved “to a comfortable level” to the midpoint of the bank’s target range of 3% to 6%, its monetary policy committee’s (MPC) “dogged insistence to maintain a real prime rate of between 6% and 7% defies logic”.

“One of the most valid criticisms of the MPC’s ignorance of the plight of South African households is the fact that, in real terms, total household credit extension, which is valued at more than R2 trillion, has declined by 5.5% since 2013, which means that there has not been any growth in this key macroeconomic indicator over the past decade,” he said.

“It is simply not possible for the South African economy to grow at meaningful and sustained rates in the absence of real growth in household credit extension,” Botha said.

However, the central bank has defended its monetary policy, saying it is in the interests of the economy and the poor, who are most affected by rising prices, to use higher rates to stabilise inflation.

Standard Bank economist Elna Moolman said policy should be “forward-looking” as it takes time for interest rates to affect the economy.

“The monetary policy stance in 2020, or now, should therefore not really be viewed in the light of the prevailing inflation rate, but it should be viewed in the context of inflation forecasts.

“Inflation early in 2020 was indeed similar to the current levels, but in 2020, inflation fell rapidly during the pandemic/lockdown, while the economy entered a deep contraction.

“At this stage, the economy is in better shape than it was in 2020 and inflation is forecast to ease more gradually. In 2020, inflation fell to below the inflation target range, while inflation is now forecast to retreat to around the midpoint of the target range (with a temporary dip below 4.5%),” Moolman said.